Far better an approximate answer to the right question, which is often vague, than an exact answer to the wrong question, which can always be made precise.

– John Tukey

Far better an approximate answer to the right question, which is often vague, than an exact answer to the wrong question, which can always be made precise.

– John Tukey

From Paul Krugman, “Inequality Is a Drag” (emphasis mine):

Consider, for example, what we know about food stamps, perennially targeted by conservatives who claim that they reduce the incentive to work. The historical evidence does indeed suggest that making food stamps available somewhat reduces work effort, especially by single mothers. But it also suggests that Americans who had access to food stamps when they were children grew up to be healthier and more productive than those who didn’t, which means that they made a bigger economic contribution. The purpose of the food stamp program was to reduce misery, but it’s a good guess that the program was also good for American economic growth.

[By] running a high unemployment policy the government is transferring money from low and moderate income people to … higher income people. We could bring the unemployment rate down to 5.0 percent or possibly 4.0 percent with larger government deficits or a lower valued dollar, which would reduce the size of the trade deficit. The lower rate of unemployment would not only give millions more people jobs, it would also give workers in the bottom half of the wage distribution the bargaining power necessary to raise their wages. These workers would then have more money, while high income households would have to pay more for help.

See Bruder being interviewed on MSNBC here. And an excerpt from her article:

Aging isn’t what it used to be. In an era of disappearing pensions, wage stagnation, and widespread foreclosures, Americans are working longer and leaning more heavily than ever on Social Security, a program designed to supplement (rather than fully fund) retirement. For many, surviving the golden years now requires creative lifestyle adjustments. And for those riding the economy’s outermost edge, adaptation may now mean giving up what full-time RV dwellers call “stick houses” to hit the road and seek work….

“We’re facing the first-ever reversal in retirement security in modern U.S. history,” Monique Morrissey of the Economic Policy Institute in Washington, D.C., told me. “Starting with the younger baby boomers, each successive generation is now doing worse than previous generations in terms of their ability to retire without seeing a drop in living standards.”

That’s what thirty years of Reaganism and neo-liberal (i.e. Clinton) economics gets us. It’s what happens when you piss on the New Deal. To my Democratic and Democrat-leaning friends out there, you’re deluding yourself if you believe for a moment that electing socially liberal multi-millionaire business people (or lawyers that serve them) will turn things around.

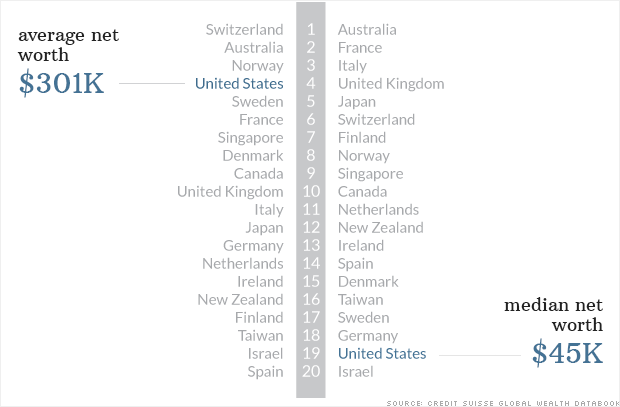

Apologies to President Business but Tami Luhby suggests that perhaps it’s not, America’s Middle Class: Poorer than you think:

Brad DeLong points us to Matt Yglesias, The US recovery has been a disaster; the eurozone’s has been much worse:

As this chart from the OECD’s new report on the US economy shows, the economic recovery in the United States has been incredibly weak.

But it’s also been enormously stronger than the recovery in the eurozone. If you want to know whether things like the 2009 stimulus bill and the various iterations of quantitative easing have worked, this is the comparison you need to look at. Have they worked to make the economy healthy? No. Have they worked to make the economy healthier than it’s been in the place where they didn’t do that stuff? Absolutely.

There’s no such thing as a well-controlled experiment in macroeconomics. This is about as you’re ever going to see. The US enacted a modest stimulus. In contrast, Europe went all in for austerity. Modest stimulus won.

It’s important to understand that recessions can have many different causes, and the optimal response from policymakers depends critically on the type of recession that occurs. Recessions can be caused by oil price shocks, Fed-induced interest rate spikes, a fall in business and consumer confidence, a drop in productivity, housing bubbles, financial meltdowns and other factors that cause either a reduction in aggregate demand or supply.

And the correct policy response after, say, an oil price shock is very different from the policy needed to respond to fall in business and consumer confidence.

If you’re reading this then decent odds that you’re aware of economist Thomas Piketty’s new book, Capital in the 21st Century. (I’ve cited journal articles by he and Emmanuel Saez as well as this op-ed piece they authored [1].) If you’re not familiar, here’s a snippet from the Overview at the Barnes & Noble website:

Questions about the long-term evolution of inequality, the concentration of wealth, and the prospects for economic growth lie at the heart of political economy. But satisfactory answers have been hard to find for lack of adequate data and clear guiding theories. In Capital in the Twenty-First Century, Thomas Piketty analyzes a unique collection of data from twenty countries, ranging as far back as the eighteenth century, to uncover key economic and social patterns. His findings will transform debate and set the agenda for the next generation of thought about wealth and inequality.

That Piketty undertook a data-based analysis makes his effort noteworthy in and of itself. You have tip your hat to someone does a deep dive into data, tries to suss out significant trends and relationships, and reports back their findings. Long story short, Piketty examined data from the past 200 years across multiple nations and concluded that inherited wealth has ensured the dominance of a small class of people and, barring public policy changes, it will continue to do so for the foreseeable future. Recently however Chris Giles, a columnist for the Financial Times, uncovered some errors in Piketty’s book. He reported his findings in “Data Problems with Capital in the 21st Century” (Note: The article is behind a registration wall). Piketty has not yet responded point-by-point to Giles but read his Big Picture response here.

An excerpt from Robert Borosage’s What Is the New Populism?

Today, in Washington, the Campaign for America’s Future is convening a major summit on The New Populism, keynoted by Sen. Elizabeth Warren. (It will be live streamed on our website). What follows are excerpts from remarks I will deliver at that meeting.

What is the new populism? The Princeton dictionary defines populism as “a political doctrine that supports the rights and powers of the common people in their struggle with the privileged elite.”

Not bad for a dictionary.

The New Populism arises from the stark truth about today’s America: Too few people control too much money and power, and they’re using that control to rig the rules to protect and extend their privileges.

This economy does not work for working people. This isn’t an accident. It isn’t an act of God. It isn’t due to forces of technology and globalization that can’t be changed. It isn’t a mistake. It is a power grab.