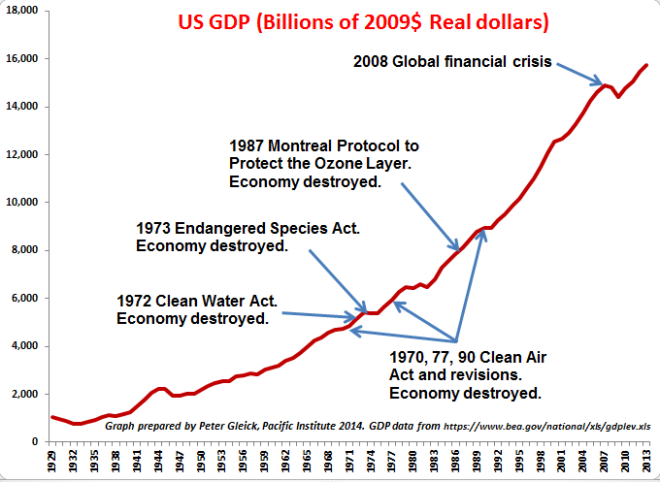

An instructive chart from David Roberts via The Weekly Sift, the Gross Domestic Product of the United States since 1929:

Category Archives: Economics

Emily Atkin, Industry Groups Are Freaking Out About Obama’s New Smog Pollution Rule

Emily Atkin had a piece at Think Progress this week, Industry Groups Are Freaking Out About Obama’s New Smog Pollution Rule. The nickel summary: The EPA has issued a draft rule intended to reduce urban smog. The usual suspects object; however, “both industry groups and Republicans have been overestimating the cost of regulations like this since the EPA first began issuing regulation of this kind.” A longer excerpt including estimated vs actual costs of regulation:

The Environmental Protection Agency issued a new draft proposed rule on Tuesday to tighten already-existing restrictions on ground-level ozone pollution, the main ingredient of urban smog.

Under the draft proposal, states would be required to lower the level of ozone pollution allowed to be in the air. Right now, the current standard is 75 parts per billion, and the new rule would change that to somewhere between 65 to 70 parts per billion. The rule would require some states with bad pollution to expand their ozone pollution monitoring, and require improvements to systems that notify the public when their air quality is at an unhealthy level.

The EPA predicts this will do wonders for public health and, by extension, the economy….

As it happens, industry groups and a number of high-ranking Republicans do not agree with the EPA. Instead, they are already predicting doom — and if you can believe it, they’re a little more exasperated than usual.

Taibbi’s back – The $9 Billion Witness: Meet JP Morgan Chase’s Worst Nightmare

Matt Taibbi is back with Rolling Stone. From his Nov. 6, 2014 story, The $9 Billion Witness: Meet JP Morgan Chase’s Worst Nightmare –

She tried to stay quiet, she really did. But after eight years of keeping a heavy secret, the day came when Alayne Fleischmann couldn’t take it anymore.

“It was like watching an old lady get mugged on the street,” she says. “I thought, ‘I can’t sit by any longer.'”…

Fleischmann is the central witness in one of the biggest cases of white-collar crime in American history, possessing secrets that JPMorgan Chase CEO Jamie Dimon late last year paid $9 billion (not $13 billion as regularly reported – more on that later) to keep the public from hearing.

Back in 2006, as a deal manager at the gigantic bank, Fleischmann first witnessed, then tried to stop, what she describes as “massive criminal securities fraud” in the bank’s mortgage operations.

Thanks to a confidentiality agreement, she’s kept her mouth shut since then. “My closest family and friends don’t know what I’ve been living with,” she says. “Even my brother will only find out for the first time when he sees this interview.”

Six years after the crisis that cratered the global economy, it’s not exactly news that the country’s biggest banks stole on a grand scale. That’s why the more important part of Fleischmann’s story is in the pains Chase and the Justice Department took to silence her.

She was blocked at every turn: by asleep-on-the-job regulators like the Securities and Exchange Commission, by a court system that allowed Chase to use its billions to bury her evidence, and, finally, by officials like outgoing Attorney General Eric Holder, the chief architect of the crazily elaborate government policy of surrender, secrecy and cover-up. “Every time I had a chance to talk, something always got in the way,” Fleischmann says.

Total recall

A piece in today’s NY Times reminded me of an article in the NYT Magazine and subsequent letter to the editor from nearly 20 years ago. It was concise and lucid. (Read the comments section from today’s piece to see why I was reminded.) I’ll adapt Kaplan’s letter for today’s times:

The 0.1% are part of a culture that values only the act of selling something for more than it was bought. When they and other like them are finished, they will, no doubt, have become more wealthy and more powerful. Yet they will have contributed so very little to the society from which they skim their profits. For all their talent, they offer nothing to the arts, nothing to the sciences and nothing to our shared stock of human ideas.

That’s it in a nutshell. From my standpoint, the super rich do little more than consume resources and generate huge piles of excrement. You want to understand my class hostility? There it is in one paragraph.

PS Dean Baker addresses Sorkin’s criticism of Sen. Warren here.

PPS A less angry take on compensation disparities and the super rich: Janna Malamud Smith, Toward A Better America: Readjusting The Value Of Low-Paid, High-Commitment Work. (I’m not a low-paid worker but I respect people who take on low-paid high-commitment work.)

Robert Stavins, An Economic View of the Environment

An interesting blog: Robert Stavins, An Economic View of the Environment.

Prof. Stavins is a member of the Core Writing Team behind the Intergovernmental Panel on Climate Change‘s (IPCC) Synthesis Report. (See also the Summary for Policy Makers of the Synthesis Report.)

What last night’s election wasn’t about

I think Jared Bernstein captures a significant element of why Democrats lost so badly on the national level – and in many states – on Nov. 4. An excerpt from What I didn’t hear on economic policy in the runup to the midterms:

… [H]ere’s what last night’s election wasn’t about:

“Yes, the economy has been growing and unemployment has been falling. No question, GDP is up, and solidly. But it’s hard to see much of that in your paycheck. In fact, most of the folks getting the growth don’t depend on paychecks; they depend on portfolios.

“Why is it that so little GDP growth is reaching average folks? Because there aren’t enough good jobs, because the trade deficit is too large, because finance is booming compared to manufacturing, because there’s too much outsourcing and offshoring and part-timing and subcontracting … and far too little ability to bargain for a fair slice of the growing pie – a pie you’re helping to bake!

“You don’t fix these problems by cutting taxes, ‘red tape,’ or getting rid of Obamacare. You don’t fix them by hating on the guy in White House or anybody else. You don’t even fix them today by providing better education for kids, though that’s a critical piece of what’s missing and will undoubtedly help them in the future.

“You fix them by fixing them: If the private sector isn’t creating enough jobs, then we need to invest in public goods that will generate more demand. We accept the Federal Reserve as lender of last resort when credit markets fail. Well, if we want to elevate full employment to be the national goal that it should be, then the government must be the job creator of last resort when the private sector fails.

“You fix them by fighting back when our trading partners depress the value of their currencies to get an export edge over us and by reviving the labor standards that will make sure people get the pay they deserve, whether its overtime or a decent minimum wage or the flexible scheduling you need to balance work and family.”

We might well have gotten our asses kicked if we’d made that argument. We’ll never know. But if we’re going to get beat let’s at least go down having done the right thing.

Thought for the Day: 3 November 2014

John Osalvo, “gee dont see this on fox news ?!?“:

I think that the people at Digital Globe know what they’re doing

A colleague sent me a link to Digital Globe’s presentation at an “Investor Conference” last year. Yeah, I know, investor conference presentations are loaded with propaganda but I believe there’s considerable substance behind their charts. (Ever have the feeling you’re not working for the right company? No? Nah, me neither.)

PS Recall that Digital Globe is the company behind the WorldView satellites.

Left Behind

I linked to it in this week’s Digest but Binyamin Appelbaum’s piece, Fed Says Growth Lifts the Affluent, Leaving Behind Everyone Else, is worth noting again:

Economic growth since the Great Recession has improved the fortunes of the most affluent Americans even as the incomes and wealth of most American families continue to decline, the Federal Reserve said Thursday.

For the most affluent 10 percent of American families, average incomes rose by 10 percent from 2010 to 2013. For the rest of the population, average incomes were flat or falling.

The least affluent families had the largest declines. Average incomes dropped by 8 percent for the bottom 20 percent of families, the Fed reported in its triennial Survey of Consumer Finances, one of the most comprehensive sources of data on the financial health of American families.

Jared Bernstein’s recommended Labor Day Reading

Jared Bernstein’s recommended Labor Day Reading:

Some great articles worth a look on labor, unions, wages, and more.

EJ Dionne on an exemplary employer and the workers who went to bat for him.

Jon Cohn interviews one of the deepest thinkers I know on labor issues: Rich Yeselson.

An important look at the problem of “wage theft” in the NYT.

A strong NYT editorial with good ideas as to useful policies to address the deficits in labor’s bargaining power that I discuss here.