100th post!!!

Economics

- Chye-Ching Huang, Budget Deal Makes Permanent 82 Percent of President Bush’s Tax Cuts:

“The Joint Committee on Taxation (JCT) and Congressional Budget Office estimate that making permanent all of the Bush tax cuts would have cost $3.4 trillion over 2013-2022…JCT estimates show that [the American Taxpayer Relief Act of 2012] makes all but $624 billion of those $3.4 trillion in tax cuts permanent. It thus makes permanent 82 percent of the Bush tax cuts, while letting 18 percent expire.”

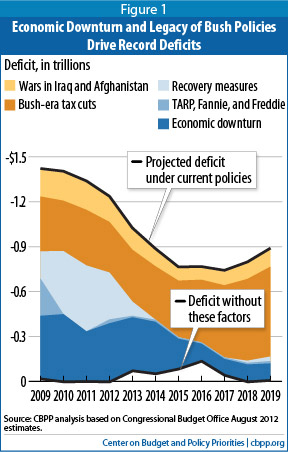

Well, it’s a good thing that those tax cuts weren’t a major contributor to the deficit. As you can see from this chart:

Oops. Looks like they were a major contributor to the deficit. In fact, it looks like they were the biggest contributor. And Pres. Obama and Congressional Democrats struck a deal to make 82 pct of them permanent. Nice work. In fact, looking at the chart, the other major driver is the economic downturn. And yet, from what I can tell, the administration does little more than pay lip service to boosting employment. @#$%. Get with it, folks. (The Fiscal Cliff deal stunk. No apparent plan or effort to boost employment. Those things plus Joe Nocera’s column noted below put me in a fine mood for the week.)

“Even making the unlikely assumption that deficit reduction in the near future would reduce rather than increase the long-run burden of the debt, the fact is that the debt-to-GDP ratio is now stable until at least 2020. A lower debt-to-GDP ratio would be a good thing in the long run, but there is absolutely no urgency.”

- The guy who does our taxes on the tax rates established in the Fiscal Cliff deal: “They call it the American Taxpayer Relief Act of 2012. There were more casualties in the War of 1812.”

- Zachary Goldfarb, What top Republican economists say about the debt limit: Comments form the other side. Judge for yourself.

- Bruce Bartlett, Coins, Bills, and the National Debt: Wild-eyed radical Bartlett explains how the accounting would work if the Treasury minted a trillion-dollar platinum coin. His explanation complements those of Laurence Tribe and former US Mint director Philip Diehl which I linked to last week. (PS I fully expect the Debt Ceiling issue to come up again in a few months. Don’t bank on this being the last you hear of the platinum coin.)

- Josh Bivens and Andrew Fieldhouse, The congressional GOP has smothered a more rapid economic recovery:

“The [Budget Control Act of 2011] cuts have already done damage, and will all-but-surely slow growth in the rest of 2013 as well. The various components of the BCA accounted for about one-third of the total fiscal drag exerted by the major components of the “fiscal cliff” that was facing Congress ahead of the lame duck budget deal. And the components of the BCA account for 48 percent of the remaining fiscal drag unaddressed by the deal—a drag that is poised to shave 1.0 percentage point from real GDP growth in 2013.”

Politics

- Joe Nocera, The Foreclosure Fiasco:

“[Jessica Silver-Greenberg’s] “story behind the story” of the $8.5 billion settlement between federal bank regulators and 10 banks over their foreclosure misdeeds illustrates just about everything that is wrong with the way the government has handled the Great Foreclosure Crisis.”

I had several posts about this earlier in the week. It was Nocera’s column (pointing me to Silver-Greenberg’s article) plus the godawful Fiscal Cliff deal which made the following column resonate with me. It would have anyway but recent events made it seem particularly relevant.

- Thomas Edsall, Now What, Liberalism?:

“In many respects, liberalism is a fat target. Dozens of city and state public employee pension plans are on the verge of bankruptcy – or are actually bankrupt…The national debt exceeds $16 trillion…

Liberalism now faces the job of paying for its own success in helping people live longer. The progressive ethos, currently embattled, has a proud history. What is uncertain is whether a durable social consensus can be mobilized in the face of the global economic pressure to reduce taxes and limit the scope of government. The Democratic left faces a daunting, but not necessarily insurmountable, obstacle.”

- Drew Westen, What Happened to Obama’s Passion?:

“When Barack Obama rose to the lectern on Inauguration Day [in 2009], the nation was in tatters. Americans were scared and angry. The economy was spinning in reverse. Three-quarters of a million people lost their jobs that month. Many had lost their homes, and with them the only nest eggs they had. Even the usually impervious upper middle class had seen a decade of stagnant or declining investment, with the stock market dropping in value with no end in sight.

Hope was as scarce as credit. In that context, Americans needed their president to tell them a story that made sense of what they had just been through, what caused it, and how it was going to end. They needed to hear that he understood what they were feeling, that he would track down those responsible for their pain and suffering, and that he would restore order and safety…

But there was no story — and there has been none since.”

Westen’s criticism is as relevant now as it was when he wrote that piece in 2011.

- John Howard, I Went After Guns, Obama Can Too:

“Six weeks [after I was elected Prime Minister of Australia] a psychologically disturbed man, used a semiautomatic Armalite rifle and a semiautomatic SKS assault weapon to kill 35 people in a murderous rampage… After this wanton slaughter, I knew that I had to use the authority of my office to curb the possession and use of the type of weapons that killed 35 innocent people. I also knew it wouldn’t be easy…

In the end, we won the battle to change gun laws because there was majority support across Australia for banning certain weapons. And today, there is a wide consensus that our 1996 reforms not only reduced the gun-related homicide rate, but also the suicide rate. The Australian Institute of Criminology found that gun-related murders and suicides fell sharply after 1996. The American Law and Economics Review found that our gun buyback scheme cut firearm suicides by 74 percent. In the 18 years before the 1996 reforms, Australia suffered 13 gun massacres — each with more than four victims — causing a total of 102 deaths. There has not been a single massacre in that category since 1996. Few Australians would deny that their country is safer today as a consequence of gun control.”

- Boston Globe, Governor Deval Patrick proposes $1.9b tax increase to fund education, transportation plans:

“Patrick called for a 1 percentage point increase, from 5.25 percent to 6.25 percent, in the state income tax. At the same time, he called for a decrease in the sales tax from 6.25 percent to 4.5 percent. The net effect of his proposals, which included a number of other changes to the tax code, would be $1.9 billion in new revenue to fund an ambitious and expensive new agenda for 2013…”

- Lt. Gov. Tim Murray will not be running for Governor in 2014. I don’t think too many people were expecting him to run but now it’s official.

Health Care

- Sarah Kliff, Can Oregon save American health care?:

“Oregon is pursuing the Holy Grail in health-care policy: slower cost growth. If it succeeds, it could set a course for the rest of the country at a pivotal moment for the Affordable Care Act [a.k.a. Obamacare] …

“For the last 30 years, both the private and public sector have done the same things to manage health-care costs,” said Bruce Goldberg, the Oregon Health Authority director who oversees the Medicaid program. “They’ve cut people from coverage, cut payment rates or cut benefits. It’s been 30 years of doing that, and we haven’t solved the problem.” This time around, Oregon wanted to try something different. Instead of dropping patients, the goal is to make high-quality health care less expensive.”

That last comment is followed by an explanation of how they plan to achieve their goal. I like this. They have a worthy goal, a credible plan for achieving it, and ways to assess whether their plan is working. That’s how you solve real-world problems.

- John E. McDonough, Holes in the ACA: A Damage Assessment:

“By my count… there have been eight consequential, substantive changes to the ACA since its signing in March 2010. Seven were done by Congress and one by the U.S. Supreme Court (SCOTUS). I list them in order of consequence, recognizing that many will disagree with my rankings…”

Aaron Swartz

- New York Times, Aaron Swartz, Internet Activist, a Creator of RSS, Is Dead at 26, Apparently a Suicide

- Aaron Swartz, Who Writes Wikipedia?

- Larry Lessig, Prosecutor as Bully

- Eileen McNamara, Carmen Ortiz’s Case Didn’t ‘Kill’ Aaron Swartz

Mathematics and Statistics

- Larry Wasserman, Bootstrapping and Subsampling, Part I:

“Bootstrapping and subsampling are in the “amazing” category in statistics. They seem much more popular in statistics than machine learning for some reason.”

I’ve never had occassion to do bootstrapping although I’ve considered it for some projects. It’s a useful way of estimating the value of a model parameter and the confidence limits associated with that estimate.

Uncategorized

- Boston Globe, 8000-panel solar farm proposed in Mass.