Fiscal Cliff Deal

I Do Not Understand the Obama Administration, Brad DeLong.

The big reason to make a deal before January 1, 2013 was that detonating the “austerity bomb” would impose 3.5% of fiscal contraction on the U.S. economy in 2013, and send the U.S. into renewed recession. It was worth making a good-enough deal–sensible long-run revenue increases and tax cuts to close the long-run fiscal gap plus enough short-term fiscal stimulus to make the net fiscal impetus +1.0% of GDP–in order to avoid renewed recession.

But by my back-of-the-envelope count, the deal the Obama administration has agreed to still leaves a net fiscal impetus of -1.75% of GDP to hit the U.S. economy in 2013. That is only 40% of the way back from the “austerity bomb” to where we want to be. That isn’t enough to make it worthwhile to make a deal before the new congress.

After Boehner’s reelection as Speaker and after the expiration of the Bush tax cuts eliminates the U.S.’s structural deficit, the politics become very different…

The Estate Tax Is a Huge Giveaway in the Fiscal-Cliff Talks, Matthew O’Brien.

It will cost us $375 billion over the next decade if we keep the estate tax from going back to its Clinton-era levels. That’s twice the savings from switching to chained CPI.

[Note: I don’t know what the final resolution of the Estate Tax was. O’Brien’s piece preceded the deal.]

RIP: The Bush Tax Cuts; They Have Become the Obama Tax Cuts, Joe Weisenthal

Thanks to last night’s Fiscal Cliff deal, we an now put to bed the term “The Bush Tax Cuts.” As of now, they’re the Obama Tax Cuts. It should be noted, that income taxes are lower for everyone today than they would have been if the American Taxpayer Relief Act hadn’t gone into effect. While top marginal rates are rising for those making over $400K, those earners still get a cut on their income up to $400K. The difference between the Obama Tax Cuts and the Bush Tax Cuts? Obama’s are permanent.

The Obama Tax Cuts: Now It Is Time to Think About Funding Them…, Brad DeLong

And now on to our big long-run problem:

Unfunded tax cuts are, in the long run, bad juju. We cannot make policy on the expectation that the U.S. will always be able to borrow at negative real interest rates. And we should make policy aiming for a low debt-to-GDP ratio, because emergencies will arise in which we will want to boost federal spending quickly and substantially to attain important national purposes.

Obama needs a policy to fund these tax cuts–not in the short-term or (probably) in the medium-term but in the long run.

What is that policy going to be? Carbon tax? Include health and other benefits in the tax base? Cut defense spending? Lower the top bracket amount down to $100K? Inquiring minds would like to know…

Perspective on the Deal, Paul Krugman

And on the principle of the thing, you could say that Democrats held their ground on the essentials – no cuts in benefits – while Republicans have just voted for a tax increase for the first time in decades. So why the bad taste in progressives’ mouths? It has less to do with where Obama ended up than with how he got there. He kept drawing lines in the sand, then erasing them and retreating to a new position. And his evident desire to have a deal before hitting the essentially innocuous fiscal cliff bodes very badly for the confrontation looming in a few weeks over the debt ceiling. If Obama stands his ground in that confrontation, this deal won’t look bad in retrospect. If he doesn’t, yesterday will be seen as the day he began throwing away his presidency and the hopes of everyone who supported him.

For Obama, a Victory That Holds Risks, David Leonhardt

For President Obama and his Democratic allies in Congress, the fiscal deal reached this week is full of small victories that further their largest policy aims. Above all, it takes another step toward Mr. Obama’s goal of orienting federal policy more toward the middle class and the poor, at the expense of the rich.

Yet the deal, which the Senate and the House have passed and Mr. Obama has signed, also represents a substantial risk for the president.

When House Republicans made it clear that they opposed a big deal, however, Mr. Obama decided to take the smaller deal, bank a series of victories and wait to fight another day. The alternative – debated inside the White House, but not ultimately a close call – would have been to go over the cliff in the hope of forcing Republicans into a larger deal.

Without that larger agreement, Mr. Obama will be left to find solutions to future budget deadlines without the leverage that came with the prospect of automatic tax increases.

Economics (general)

The Year in Review II: Yet More Fantastical Pseudo Economics, Menzie Chinn (Econobrowser)

Time to emulate the media’s “year in review” pieces, with my own take on the most outrageous, nonsensical assertions presented in the guise of analysis. Here are my ten most hilariously deluded excursions into the fantasy world from my postings to Econbrowser. The inspirations range from (once again) the Heritage Foundation’s analyses … to the ongoing search for hyperinflation/ crowding out.

Empirical Evidence For High Fiscal Policy Multipliers, Matthew Yglesias

Two papers I saw presented this morning took very different approaches to reach a similar conclusion—inside a currency union there can be big fiscal policy multipliers. In other words, large positive effects of running budget deficits and negative effects of fiscal consolidation.

Myths of Austerity, Paul Krugman

When I was young and naïve, I believed that important people took positions based on careful consideration of the options. Now I know better. Much of what Serious People believe rests on prejudices, not analysis. And these prejudices are subject to fads and fashions… For the last few months, I and others have watched, with amazement and horror, the emergence of a consensus in policy circles in favor of immediate fiscal austerity. That is, somehow it has become conventional wisdom that now is the time to slash spending, despite the fact that the world’s major economies remain deeply depressed. This conventional wisdom isn’t based on either evidence or careful analysis. Instead, it rests on what we might charitably call sheer speculation, and less charitably call figments of the policy elite’s imagination…

Politics

What Could Have Been: The Most Important Bills Blocked By Republicans In 2012, Think Progress

1. A minimum wage increase.

2. Campaign finance transparency.

3. The Buffett Rule.

4. The Employment Non-Discrimination Act.

5. U.N. treaty to protect the equal rights of the disabled.

6. The Paycheck Fairness Act.

The N.R.A.’s Blockade on Science, Gary Gutting

The N.R.A. hasn’t been winning only because it’s persistent to the point of fanaticism or because it has a powerful political organization. It also wins because it has a strong argumentative advantage in the political debate about gun control.

It has been able to neutralize empirical cases for control. In contrast to the debate over global warming, opponents of gun control aren’t easily cast as scientific know-nothings. On the contrary, they often plausibly present themselves as tough-minded empiricists offering facts to counter liberal emoting.

How to Choose the Least Unconstitutional Option: Lessons for the President (and Others) From the Debt Ceiling Standoff, Neil H. Buchanan & Michael C. Dorf.

This Article analyzes the choice the president nearly faced in summer 2011, and which he or a successor may yet face, as a “trilemma” offering three unconstitutional options: ignore the debt ceiling and unilaterally issue new bonds, thus usurping Congress’s borrowing power; unilaterally raise taxes, thus usurping Congress’s taxing power; or unilaterally cut spending, thus usurping Congress’s spending power. We argue that the president should choose the “least unconstitutional” course—here, ignoring the debt ceiling. We argue further, though more tentatively, that if the bond markets would render such debt inadequate to close the gap, the president should unilaterally increase taxes rather than cut spending.

The Bill of Rights Has A Very Bad Week, Charlie Pierce.

Of course, while everyone in Washington, and the courtier press that serves them, were endlessly droning on and on about the Gentle Fiscal Incline, the Bill Of Rights closed out 2012 by having one of the worst weeks it’s had in the two centuries of its existence…First came the revolting vote on the reauthorization of FISA…Later, came the release of some FBI documents in which it seemed to indicate at least an unacceptable level of involvement by federal law enforcement in the crackdowns by local authorities on the various outposts of the Occupy movement.

The President Goes Back on Another Promise, Charlie Pierce

I’m sure we will soon hear from some people that the fact that the president signed the new National Defense Authorization Act today, despite a previous promise to veto the measure if provisions that prevented him from closing the prison camp at Guantanamo Bay were included, because he has a “long game” strategy designed to “put the Republicans in a corner.” He also endorsed, by his signature, the principle embodied in the act that Americans can be detained indefinitely without probable cause on the suspicion of “supporting” terrorism which, of course, will mean whatever the executive department or the Commander In Chief – Trumpets, please – decide that it means.

Liberals Back to Giving Obama a Pass, John R. MacArthur

As Robert Caro’s latest installment of his Lyndon Johnson biography relates, a very regular, organization Democrat like Lyndon Johnson can makes good things happen if he puts his mind to it. When in the wake of the Kennedy assassination “wise” advisers told the new president to go slow on civil-rights reform — “that a President shouldn’t spend his time and power on lost causes, no matter how worthy those causes might be” — Johnson replied, “Well, what the hell’s the presidency for?”

Today, we might ask what the hell are liberals for? Apparently, not a hell of a lot.

Math and Science

Terence’s Stuff: Multiple Linear Regression, Part 2, Terry Steel

I really like multiple linear regression (MLR), even though I think that it must be the most widely misused of all statistical methods. There are so many different reasons why we might use it, and there are so many variations on linear least squares, I feel that MLR can be seen as a microcosm of statistics as a whole. At a conference recently I heard a speaker discuss MLRs with 15–20 variables. He spoke of model complexity, of functional forms, of whether or not variables should be selected, and he discussed model (in)stability and resampling techniques for diagnosing and improving models. All without stating a reason for doing MLR!

Data-driven science is a failure of imagination, petrkeil

Data-driven scientists sometimes call themselves informaticians or data scientists. And they are all excited about big data: the larger is the number of observations (N) the better… So why many scientists find data-driven research and large data exciting? It has nothing to do with science. The desire to have datasets as large as possible and to create giant data mines is driven by our instinctive craving for plenty (richness), and by boyish tendency to have a “bigger” toy (car, gun, house, pirate ship, database) than anyone else. And whoever guards the vaults of data holds power over all of the other scientists who crave the data….But most importantly, data-driven science is less intellectually demanding then hypothesis-driven science. Data mining is sweet, anyone can do it. Plotting multivariate data, maps, “relationships” and colorful visualizations is hip and catchy, everybody can understand it. By contrary, thinking about theory can be pain and it requires a rare commodity: imagination.

Science, politics, mathematics, and finance

This experience … revealed to me some serious issues with British science. There are a hard-core of scientists, a vocal minority, who are convinced science is undervalued, because it is under-funded and the country is not run as a technocracy. They often complain that they are not taken seriously by society, while simultaneously withdrawing from addressing issues that are of concern to society: true science is about cosmology or particle physics, not about obesity or poverty.

Uncategorized

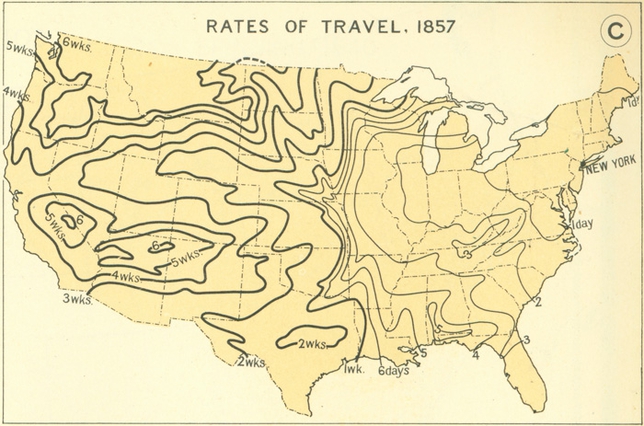

Back When 50 Miles Was A Long Way, Phil Price