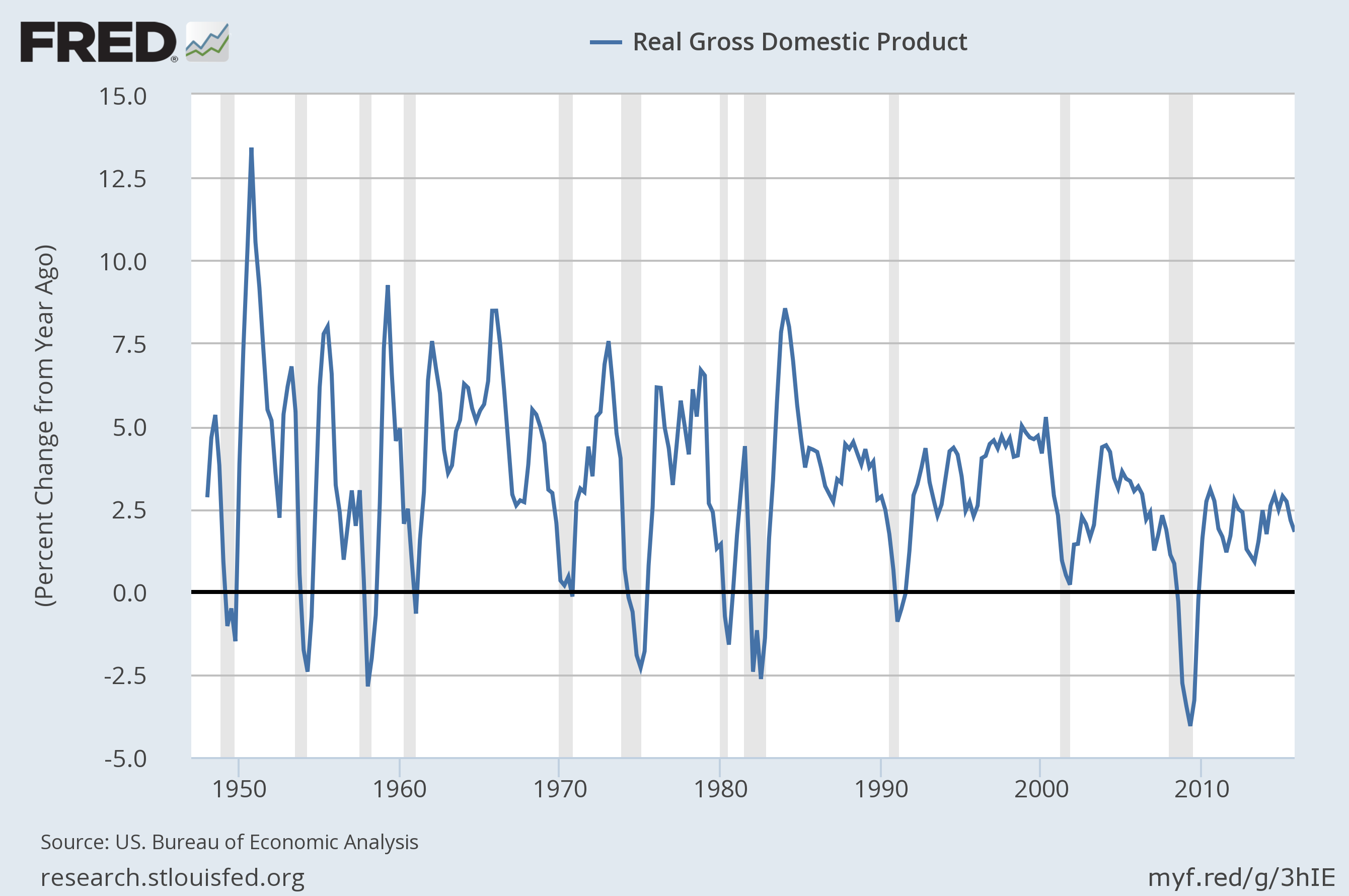

From the St. Louis Fed, here’s the annual growth in real (inflation-adjusted) U.S. Gross Domestic Product since 1947:

UMass economist Gerald Friedman predicts that, among other things, Bernie Sanders’ economic plan will raise GDP growth to 5.3%. That’s very high by contemporary standards and his prediction has caused a major kerfuffle within housebroken liberal economist circles – see also here. We haven’t had GDP growth that high since the early ’80s when we were coming out of a severe recession. As you can see from the chart, prior to that GDP growth >5.3% was a pretty regular occurrence. Can we make it a regular thing again? I’m not sure but I’m skeptical. The world is very different now than it was 35, 40, or 50 years ago. (That was pre-globalization. We had a manufacturing advantage of much of the rest of the world.) 5.3% growth now seems like a stretch. That’s a factor of about 2.5x over current. Still, if Sanders was able to enact his platform (perhaps during his second term after people who support it take the majority in the House and Senate;-) and growth were even half of what Friedman predicts that would be a significant improvement over current.