Doug Hall, Ongoing disaster evident in too many states:

Between January 2013 and April 2013, twelve states and the District of Columbia experienced decline in overall employment. Earlier signs of weakness in the Northeast and Midwest were further realized over the three-month period from January 2013 to April 2013, with the Midwest job market stagnant at 0.0 percent, and the Northeast at 0.3 percent. Both the South and West experienced growth of 0.5 percent during this period. Utah’s growth of 1.7 percent leads the nation, with Texas’ job growth of 1.0 percent the only other state at or above 1 percent growth.

In April 2013, there were four states—Nevada, Illinois, Mississippi and California—with unemployment rates of 9.0 or more (down from seven states in March). The number of states in which the unemployment rate is now less than 5.0 percent increased to nine, led by Nebraska and North Dakota, each with rates less than 4.0 percent.

Hall links to Heidi Shierholz, At a time of persistent economic weakness, today’s jobs report represents an ongoing disaster. (Shierholz is writing about the April jobs report.)

We need 8.7 million jobs to get back to a healthy labor market. The average growth rate so far in 2013 is 196,000 jobs a month; at that rate, it will take more than five years to return to the prerecession unemployment rate.

And we can look forward to feeling the full effects of sequestration effects over the coming months.

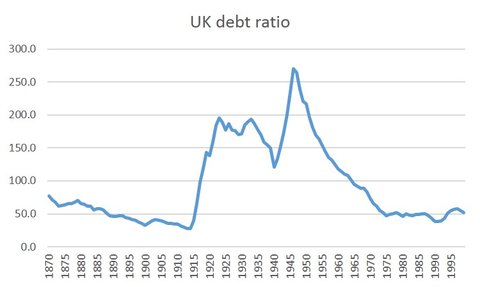

Also Paul Krugman looks at the history of UK debt as a percentage of GDP:

… our grandfathers (or strictly speaking the grandfathers of the Brits – we never had austerity of any kind) – responded to high levels of debt with an economy in which life was pretty hard for investors, luxuries were hard to come by even for the middle class, and everyone worked hard — but, you know, everyone had a job. [Note: Krugman shows a chart indicating high unemployment during Thatcher’s time.] We’ve responded to much lower levels of debt by ensuring that the economy functions far below potential, millions of people who want to work can’t find jobs, and many people see all their hopes for the future slipping away.

Progress!

Finally, we hear a lot about “The 1% versus the 99%” but not a lot of discussion about the tension between the 20% and the 80%. There’s a good exchange in the comments to this blog post by Brad DeLong, Department of “WTF?!”: Education Gap Weblogging. See also this paper.